February marked the debut of Green Week at the7stars, an initiative spearheaded by our internal sustainability team, the EcoStars. The initiative sought to celebrate all of the ways that we can be environmentally friendly and champion sustainability in our media planning, office culture, and day-to-day lives. We also wanted to celebrate all the amazing steps that our industry is making towards change.

The week kicked off with a flexitarian lunch, courtesy of the social enterprise Humdingers. We also unveiled the first edition of the EcoStars newsletter, showcasing commendable environmental initiatives by our clients. Highlights included Wagamama’s new eco-friendly uniforms crafted with PANGAIA, Higgidy’s partnership with The Garden Army, a mental health charity that champions therapeutic farming, and Avanti West Coast’s carbon emission reduction goals, aiming to slash emissions by 61% with their new Hitachi train stock. Our consumer tracking team, Lightbox, also produced a special sustainability edition of their bi-weekly Lowdown, revealing intriguing insights into consumers’ eco-consciousness, with 2 in 3 adults willing to pay extra for climate-friendly products and 57% saying that they stop shopping with brands after seeing negative climate stories about them.

Throughout the week, we hosted enlightening talks from three industry leaders in sustainability: Ad Net Zero, Scope3, and Mobsta. Ad Net Zero outlined a five-point action plan for a more sustainable advertising industry. Meanwhile, Mobsta and Scope3 shared their innovative approaches to sustainability and reducing carbon emissions, with a special guest appearance stealing hearts – Kenny, the golden retriever puppy! All three talks were incredibly informative, giving us new ideas on how to keep championing sustainability in our media plans.

- Elle Chartes from Ad Net Zero

- James Sexton-Barrow from Mobsta

- Elliot from Scope3

Finally, our Green Week celebrations ended with the7stars’ Swap Shop, a collaborative effort with the DoGooders, our charity leadership team. Transforming The Mews meeting room into a fashion oasis, colleagues brought in over 90 items of clothing and books to swap, breathing new life into pre-loved items and diverting them from landfills.

The resounding success of our inaugural Green Week left our team energised and inspired. It reinforced our commitment to crafting media plans that are not just effective but also environmentally responsible (all whilst making our office look even more fashionable!) As proud supporters of Ad Net Zero, tackling the climate crisis remains at the forefront of our agenda. With the valuable insights gained, we can’t wait to translate our learnings into action and continue championing sustainable practices.

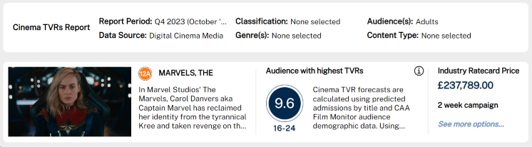

With Christmas right around the corner and 2024 in sight, now is the perfect time to consider some major releases coming out in Q1 and how they’re expected to deliver vs a variety of different audiences.

With Christmas right around the corner and 2024 in sight, now is the perfect time to consider some major releases coming out in Q1 and how they’re expected to deliver vs a variety of different audiences.

Recent Comments