Q1 2024 has started with a bumper month for free TV, with ITV’s Mr Bates vs. the Post Office clocking up more than 16 million streams on ITVX, while the second series of The Traitors more than doubled viewing figures on BBC iPlayer compared with the previous year. In addition, the UK’s four major broadcasters recently unveiled Freely, a free-to-air streaming service set to launch later this year.

Through analysis of industry data and continued tracking of consumer sentiment, the7stars’ AV team have identified four key trends which are driving the recent success of Free TV and the growth in ad-supported streaming services.

Financial Reassessment

The cost-of-living crisis has prompted individuals to limit their budget and limit their spends on services like Netflix, Amazon Prime, and Disney+. Instead, people are turning to free streaming services to keep themselves entertained without eating into their budget.

While linear television remains central to modern households, there’s been a noticeable shift in viewers’ behaviour to free streaming platforms such as Freevee, Samsung TV Plus, Roku and Pluto. In the last 12 months, Roku TV has reported a 14% YOY growth and Samsung TV Plus has similarly seen a massive 60% growth in viewership.

Slimming Down Services

Previously, consumers required multiple subscriptions to access diverse content, however recent data indicates a change in behaviour. Increasingly, consumers are being more selective in choosing which subscriptions are worth their while. According to recent data from BARB, there has been a reduction in those with two or more SVOD services from 46.4% of the population in Q3, down to 44.7% in the following quarter. As Maria Rua Aguete, Senior Research Director at Omdia, reveals, ‘This is partly driven by the increasing popularity of Free Ad-supported Television (FAST) channels, which are becoming a preferred choice for supplementary viewing’.

Shifting Perceptions

As users are diversifying their time across various platforms, public perception of free streaming services has improved, as users become accustomed to the benefits of easy accessibility. This attitude shift across free streaming services has been driven by several factors, in particular improvements in ad targeting and a more seamless user experience.

Better Quality Content

Viewers have long been platform agnostic when it comes to content, with most willing to hop between TV and streaming services in search of quality content. Accordingly, FAST services such as Samsung TV Plus have invested greatly in their output, with popular shows such as Schitts Creek and Masterchef UK helping to boost viewership figures. Such a change has not gone unnoticed: some 64% of viewers believe that content quality on FAST channels is improving.

As the FAST channel market continues to grow, this gives advertisers new opportunities and challenges to align with the correct service providers, whilst adapting to the changing landscape to keep up with evolving viewer demands.

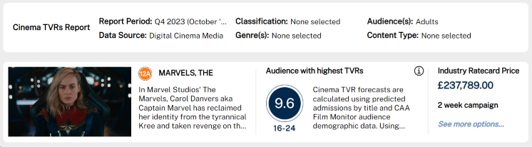

With Christmas right around the corner and 2024 in sight, now is the perfect time to consider some major releases coming out in Q1 and how they’re expected to deliver vs a variety of different audiences.

With Christmas right around the corner and 2024 in sight, now is the perfect time to consider some major releases coming out in Q1 and how they’re expected to deliver vs a variety of different audiences.

Recent Comments